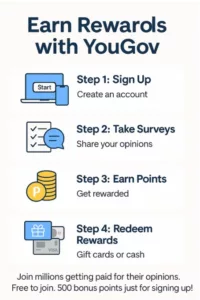

Earn Rewards with YouGov – Get Paid for Your Opinions Online

In this post, we will explore how to earn rewards with YouGov. Are you looking for an easy way to earn gift cards or cash from the comfort of your home? YouGov is a reputable market research company that rewards you for sharing your opinions through online surveys. With every survey you complete, you earn points that can be redeemed for popular retailer gift cards or even direct cash payouts.

How Does Earning Rewards with YouGov Work?

YouGov connects individuals with brands and researchers who need honest feedback on various topics—from politics and products to lifestyle habits. Your opinions help shape real-world decisions, and in return, you earn rewards.

Getting Started Is Simple

1. Sign Up for Free

Visit YouGov.com and click “Start” to create your account. It only takes a minute.

2. Complete the Intro Survey

Answer a few questions about your background and interests. This helps YouGov match you with the right surveys.

3. Confirm Your Email

Check your inbox for a verification code to activate your account.

4. Start Earning Points Instantly

You’ll get 500 bonus points just for signing up. After that, surveys will be sent directly to your inbox or available through the YouGov app.

Redeem Points for Real Rewards

Minimum Redemption:

Once you reach 25,000 points, you can cash out for $15 in rewards. The more points you earn, the greater your reward options.

Choose Your Reward Type:

Gift Cards to Amazon, Walmart, Sephora, Apple, Uber Eats, and more

Cash Deposits straight to your bank account

Prepaid Visa Cards for flexible spending

Just log in, head to the rewards section, and follow the steps to claim your reward.

Why Join YouGov?

Free to Join – No hidden costs or commitments

Earn from Home – No special equipment or skills needed

Trusted by Millions – A global platform with years of credibility

Make Your Voice Count – Influence brands, products, and decisions

Final Thoughts

Earn rewards with YouGov by sharing your thoughts on topics that matter. It’s a fun, convenient way to make some extra money or treat yourself to something special. Sign up today and start earning with your opinions.

This post may contain affiliate links. These affiliate links help support this site. For more information, please see my disclosure policy. Thank you for supporting Midwest Money Savers.