The Importance of Keeping Your Credit Utilization Under 30 Percent

Credit utilization is one of the most critical factors in managing your financial health. Yet, many overlook the significance of managing credit card debt and how it shapes their credit score. In this article, you’ll learn the importance of these credit utilization secrets. We’ll dive into why maintaining a credit utilization ratio below 30 percent is essential and how it can positively impact your financial future.

What Is Credit Utilization?

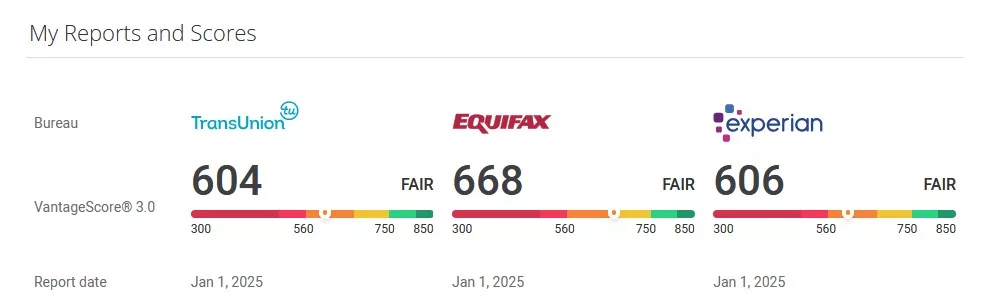

Credit utilization refers to the percentage of your available credit that you are currently using. For example, if you have a total credit limit of $10,000 and your balances total $3,000, your credit utilization rate is 30 percent. This ratio is a significant component of your credit score, accounting for about 30 percent of the overall calculation. This credit utilization secret is one of the most important ones you will learn. Not sure where your utilization is at? One of my favorite financial tools to use is CrediteroScore. With CreditHeroScore, you get monthly credit scores & alerts, credit tools, and top-of-the-line ID protection. Visit CreditHeroScore now to check out everything you get. For a limited time, they offer a 7-Day $1.00 Trial, and then a monthly membership fee of $24.99 (plus applicable tax) will apply. 1

Why it Matters

- Improves Your Credit Score:

Lenders view low credit utilization as a sign of financial responsibility. A ratio under 30 percent demonstrates that you’re not overly reliant on borrowed money, which makes you a lower risk to creditors. Conversely, high utilization can lead to a drop in your credit score, even if you make timely payments. - Signals Financial Stability:

Keeping utilization low shows that you have control over your spending and are not living beyond your means. This can make securing loans, credit cards, or favorable mortgage terms easier. - Maintains Financial Flexibility:

Low credit utilization ensures you have room to handle unexpected expenses or emergencies without maxing out your credit cards. High balances leave little room for unforeseen costs, leading to financial stress.

How High Credit Utilization Can Hurt You

Exceeding the 30 percent threshold can have several adverse effects. High utilization ratios may indicate financial strain to lenders, even if you make minimum payments on time. This perception can result in higher interest rates, difficulty securing credit, and even rejection of loans or credit cards. Your credit score may also take a hit, which could take months to recover.

Tips for Maintaining a Low Credit Utilization Rate

- Regularly Monitor Your Balances:

Keep track of your credit card balances and ensure they stay below 30 percent of your credit limit. For more information, check out my article, Unlock Financial Freedom: Mastering the 50/30/20 Budgeting Rule. - Pay Off Balances Promptly:

Making payments more than once during a billing cycle can help reduce your utilization before your statement is issued. - Request a Credit Limit Increase:

Increasing your credit limit lowers your utilization rate as long as your spending habits remain unchanged. - Spread Spending Across Cards:

If you have multiple credit cards, distribute purchases evenly to avoid high balances on any account. - Avoid New Debt:

Limit new credit applications and focus on managing your existing accounts wisely.

Conclusion

Maintaining a credit utilization ratio under 30 percent is a simple yet powerful way to safeguard your credit score and financial health. Showing lenders that you can manage credit responsibly opens doors to better financial opportunities and reduced stress. Start implementing these strategies today and build a solid foundation for a secure financial future.

This post may contain affiliate links. These affiliate links help support this site. For more information, please see my disclosure policy. Thank you for supporting Midwest Money Savers.